by Rebekah Weiner | Nov 27, 2023 | API, Deltek Costpoint

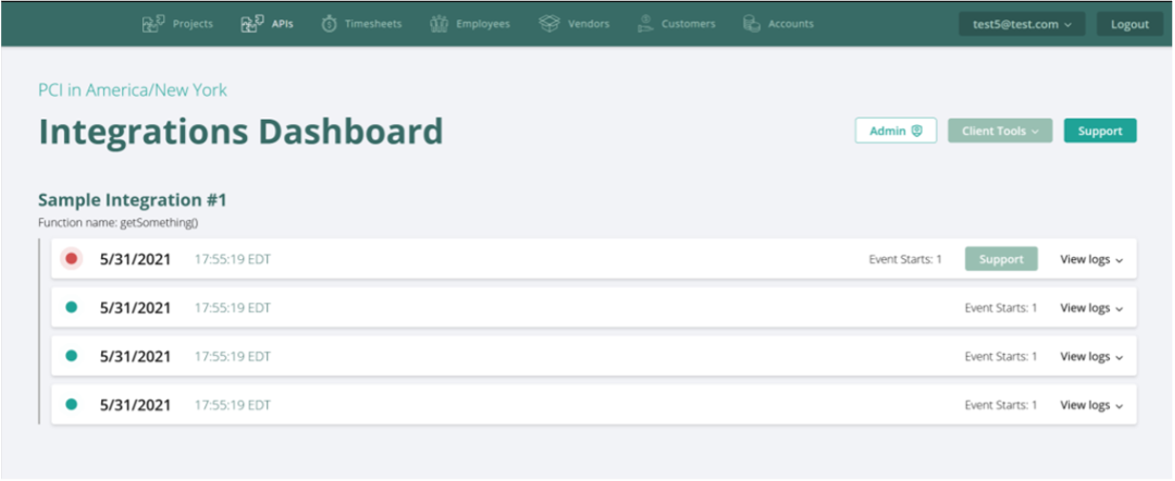

Discover the top recurring questions that our API team at PCI has encountered while working with hundreds of clients. Get the answers you need right here on API integrations with PCI. How long does it take to develop an integration? If it is a brand-new integration...

by Rebekah Weiner | Sep 29, 2023 | API

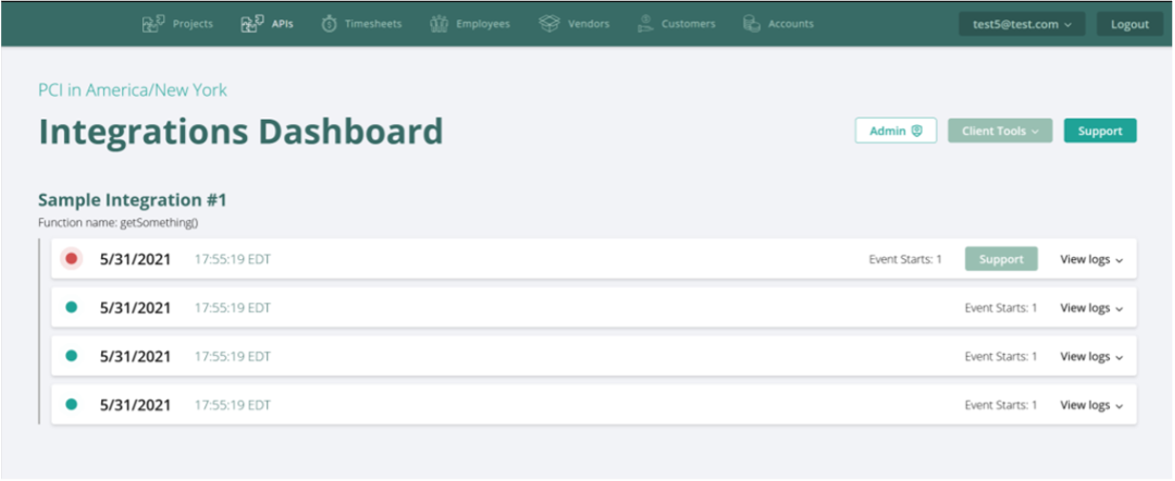

By Sandy Froonjian If you have read the previous API blogs, you should have a good understanding by now of what is involved in the integration process here at PCI. But what happens after the integration process is over? Do we just say good-bye to our client and never...

by Rebekah Weiner | Aug 21, 2023 | API, Deltek Costpoint

Written By: Sandy Froonjian At PCI, our API team occasionally encounters unique integration scenarios that fall outside our usual process. There are two main scenarios that can occur: 1. If the client’s third-part software lacks API capabilities; 2. If the client’s...

by Rebekah Weiner | Jul 25, 2023 | API, Integration

By Sandy Froonjian You’ve probably heard a lot about APIs by now, but you might still be unsure if your organization needs an API integration. Of course, creating an API integration comes at a cost, so how can you determine if it’s worth the investment for...

by Rebekah Weiner | Apr 25, 2023 | API, Deltek ConceptShare, Deltek WorkBook, Integration

By: Sandy Froonjian By now, you have heard about what an API is and how PCI can integrate your software. You may be questioning if your company can benefit from an API integration given the software you currently use. If your software has API capabilities for...

by Rebekah Weiner | Mar 14, 2023 | API, Deltek Costpoint, Deltek WorkBook, Integration

Written by: Sandy Froonjian In my previous article, I provided a general overview of what the API team at PCI does. In this article, I’m going to get more technical and explain the details of how we work with our clients to accomplish that integration. To begin...