Want to have a direct impact on your bottom line and keep your team happy? Whether you’re an agency leader, project manager, or creative director, you should look no further than WorkBook. Built for agency leaders by agency veterans, WorkBook is a leading online project, financial, and workflow management tool all in one.

Think of some of the tedious work that eats up your day, whether its monthly financial reports, preparing dozens of client updates, or even manual data entry into workback plans. Streamlining these deliverables through one tool means winning back time to pursue other areas of work that can be more meaningful and propel your bottom line. It also leads to happier teams: who wouldn’t want to automate away repetitive tasks that unnecessarily take up time? WorkBook helps agencies scale up their ambition and deliver stronger work. Period.

Here are just a few ways you can make WorkBook work for you.

We’ll let MAC walk you through them:

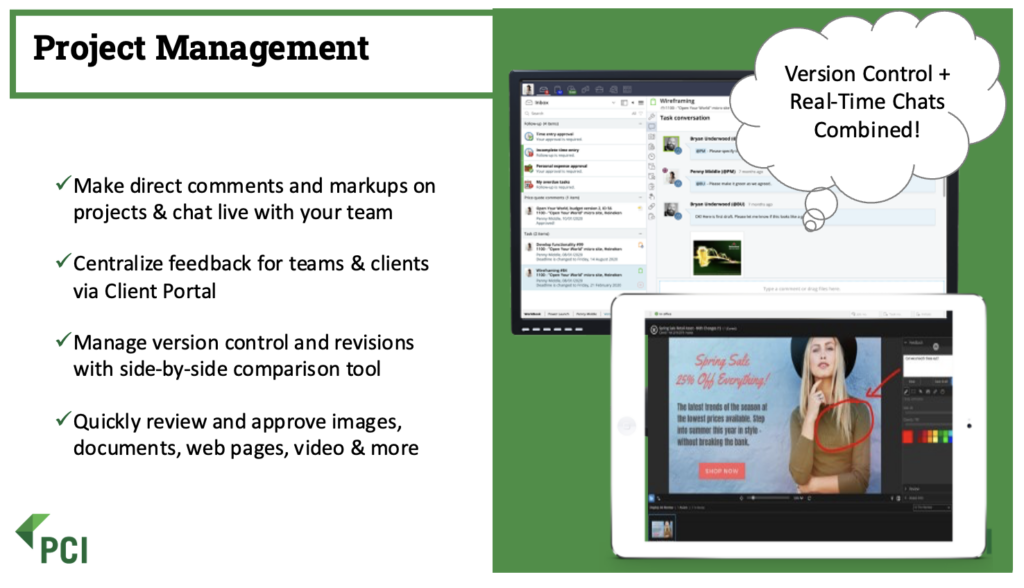

Project Management

Make project management painless with WorkBook—centralize all communication, feedback and client updates in one place! You can even manage revisions and version control directly in WorkBook.

Costs & Cash Flow

At agencies big or small, people are your biggest asset. With WorkBook you can actually prevent talent burnout through real-time reports on deliverables and resourcing as well as easy task management features. Best of all, employees can remain connected from anywhere thanks to mobile functionality.

Streamline New Biz

Streamline new biz requests by forecasting incoming work and easily building resourcing plans all with WorkBook. Bonus points: keep new clients happy and in-the-know through real-time updates via WorkBook’s Client Portal.

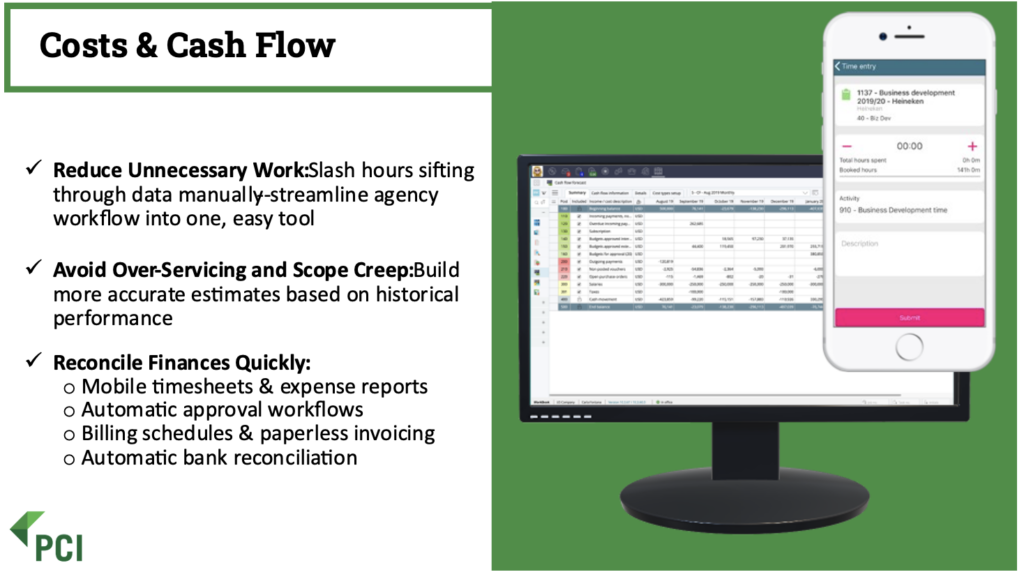

Costs & Cash Flow

WorkBook is a win-win when it comes to costs and cash flow—reduce those pesky unbillable hours, avoid over-servicing and scope creep by tapping into historical performance data, and even reconcile finances quickly through automatic approval workflows and bank reconciliation.